import yfinance

(yfinance

.Ticker("UA") # interested in UA

.history(period="1y") # downloads last year

.to_csv('/tmp/ua_1y.csv')) # saves de DataFrame as a csv fileDS - Basic stocks charts

A good way of practicing matplotlib is trying to mimic examples out there. Trading is one of those areas where charts are broadly used. I’ve checked several articles (I’ll leave the reference in the resources area) to see which ones are the most popular and then try to reproduce them using matplotlib and maybe learning something about stock analysis in the process.

All the examples in this article have been created using a Jupyter notebook. You can find the source code of the notebook here.

A little bit about indicators

After spending an hour trying to get a simple listing of what are the most common financial indicators, I kind of came up with the following summary. There’re two main types of financial indicators, lagging indicators and leading indicators. Lagging indicators are normally used by traders to know when to enter or exit a given value, whereas a leading indicator would normally used to guess where the prices of a given stock are going to go.

I’ve also found another classification based on the required information the trader needs at a given time of the process, here’s a summarized table:

| TOPIC | TYPE | CHART | EVALUATES… |

|---|---|---|---|

Trend |

LAGGING |

how the market is moving (up, down, stays still) |

|

Mean |

LAGGING |

how far the price is going before changing direction |

|

Relative strength |

LEADING |

oscilations in buying and selling pressure |

|

Momentum |

LEADING |

the speed of price change over time |

|

Volume |

LEADING / LAGGING |

whether traders are cautious or greedy |

Getting the data

Yfinance is a Python library which uses the Yahoo Finance API to access stock related information. There’re thousands of stock values out there, in this ocasion I’m getting Under Armour last year values.

Then I’m creating a Jupyter notebook where I’m importing the csv to analyze the data and create the chart with the indicators.

import pandas as pd

ua = pd.read_csv('ua_1y.csv')

ua.head()First I’m creating a line chart with all the loaded prices:

import numpy as np

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

xs = pd.to_datetime(ua['Date'])

ys = ua['Close']

def base_plot():

plt.plot(xs, ys)

plt.title('UNDER ARMOUR STOCK PRICES (OCT-2019 - OCT-2020)')

plt.ylabel('PRICE (US Dollars)')

plt.yticks(np.arange(np.floor(ys.min()) - 2, np.ceil(ys.max()) + 4, step=2))

xaxis = plt.gca().xaxis

xaxis.set_major_locator(mdates.MonthLocator())

xaxis.set_major_formatter(mdates.DateFormatter('%b'))

plt.margins(x=0)

base_plot()

Resources

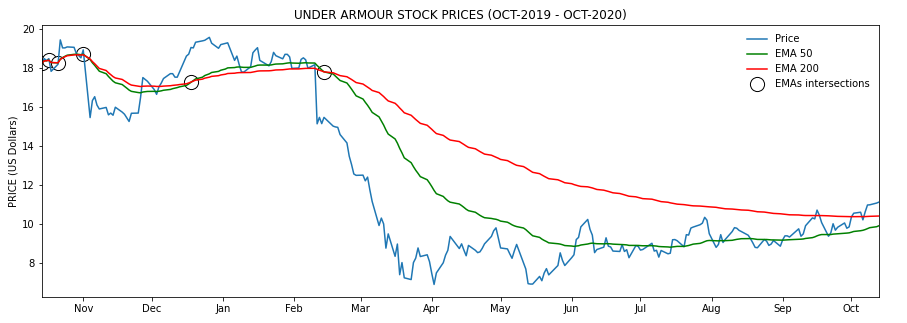

Trend: 50 and 200-day EMA

Following the table I mentioned in the beginning, I’m starting to draw both the 50 and 200-day EMA to see how the market is behaving about this stock value. EMA stands for exponential moving average and it’s supposed to be more responsive than the simple moving averages. Depending on whether we’re looking for medium of long term we would be using the 50 or the 200 days EMA.

How to calculate the EMA using Pandas ? Well, there’s the ewm function to precisely calculate functions in an exponential window. So

ua['EMA 50'] = ua['Close'].ewm(span=50).mean()

ua['EMA 200'] = ua['Close'].ewm(span=200).mean()Then is simply about plotting both dates as x values and EMAs as y values:

plt.figure(figsize=(15, 5))

# PRICE LINES

base_plot()

# EMA LINES

plt.plot(xs, ua['EMA 50'], color='green')

plt.plot(xs, ua['EMA 200'], color='red')

# INSERSECTIONS

idx = np.argwhere(np.diff(np.sign(ua['EMA 50'] - ua['EMA 200']))).flatten()

plt.scatter(xs[idx], ua['EMA 50'].iloc[idx], s=200, color='w', edgecolor='black', linewidths=1)

# LEGEND

plt.legend(['Price', 'EMA 50', 'EMA 200', 'EMAs intersections'], frameon=False)

plt.show()

There’s a few of strategies based on the relationship between the EMA and the price lines, and also between fast and slow EMAs. First it seems that when the price is above the EMA line, the price is likely to go up whereas when it’s below, it’s likely to fall. Because of that EMAs have been also been used visually as support and resistance bands.

But there’s also a relationship worth mentioning, the relationship between the 50 and 200 EMAs. This theory says that when the EMA-50 crosses from below to above the EMA-200 is an indicator that the prices are going to rise. However when the EMA-50 crosses from above to below the EMA-200 it’s an indicator that the prices are going to decrease. I’ve highlighted these intersections in the chart with the following code:

idx = np.argwhere(np.diff(np.sign(ua['EMA 50'] - ua['EMA 200']))).flatten()

plt.scatter(

xs[idx],

ua['EMA 50'].iloc[idx],

s=200,

color='w',

edgecolor='black',

linewidths=1)Mean: Bollinger Bands ©

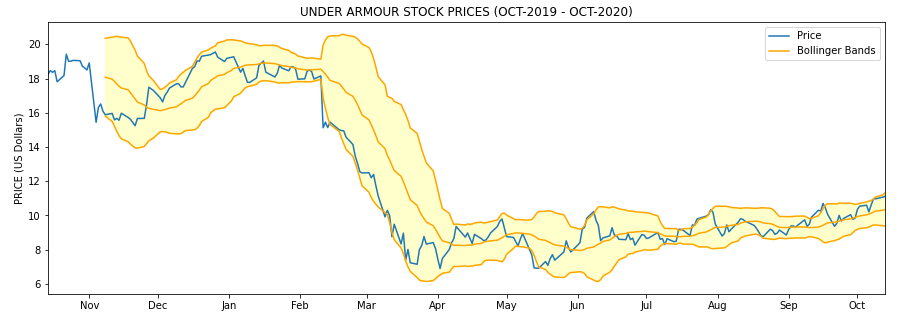

One of the most famous indicators in financial analysis is the Bollinger Bands ©. Create by John Bollinger in the 1980s to help traders to know when prices are likely to change direction there’re some indicators. It’s composed by three bands, the moving average (middle band), upper and lower Bollinger bands.

-

typical price: is the average of adding up open, close, and highest price

-

ma is a simple moving average of the typical price (typically for 20 days)

-

n is the number of standard deviations (typically 2)

-

std is standard deviation over a period of time

ua['Typical Price'] = (ua['Open'] + ua['Close'] + ua['High']) / 3

ua['MA 20'] = ua['Typical Price'].rolling(window=20).mean()

ua['STD 20'] = ua['Typical Price'].rolling(window=20).std()ua['UpperBol'] = ua['MA 20'] + (2 * ua['STD 20'])ua['LowerBol'] = ua['MA 20'] - (2 * ua['STD 20'])Now we can draw the three bands along with the price band:

plt.figure(figsize=(15, 5))

base_plot() # PRICE PLOT

plt.plot(xs, ua['MA 20'], color='orange') # MIDDLE BAND

plt.plot(xs, ua['UpperBol'], color='orange') # UPPER BAND

plt.plot(xs, ua['LowerBol'], color='orange') # LOWER BAND

plt.legend(['Price', 'Bollinger Bands'])

plt.fill_between(xs, ua['UpperBol'], ua['LowerBol'], color='yellow', alpha=0.2)

plt.show()

Here the idea is that when the price is continuously touching the upper band, that’s a signal that the price is overbought, whereas when the price is continuosly touching the lower band that means that the price is oversold:

-

Price overbought: price touching continuosly the upper band

-

Price oversold: price touching continuosly the lower band

There’re more information on how to use this indicator in the resources section.

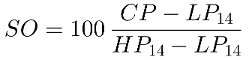

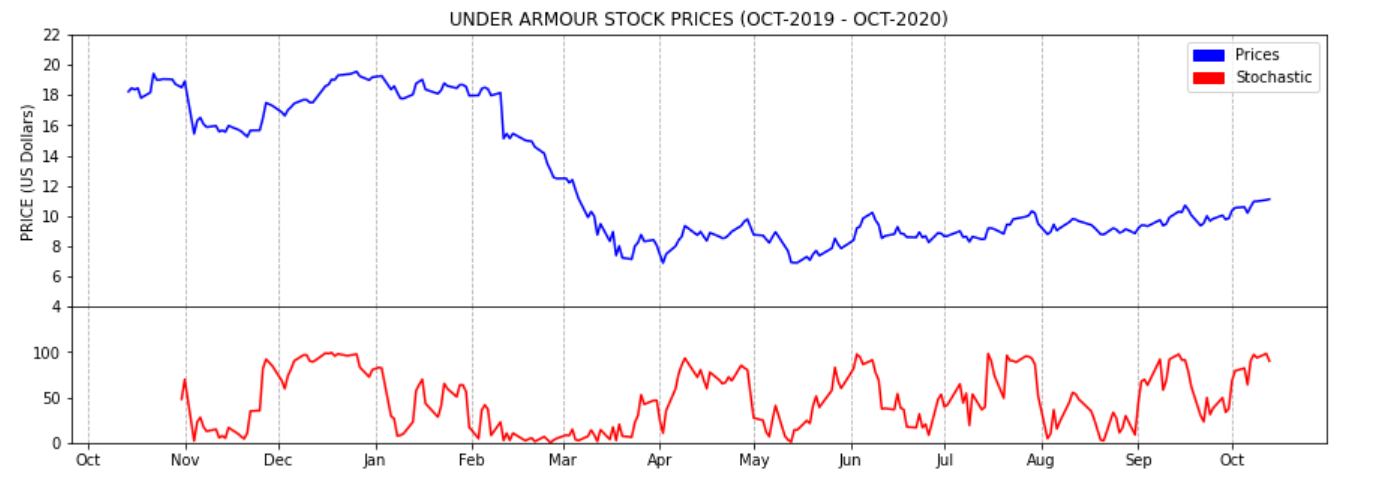

Relative strength: Stochastic Oscillator (SO)

When measuring the relative strenght of the price we’d like to know if there’s going to be a significant oscillation in the buying or selling pressure. The stochastic oscillator attempts to predict price turning points by comparing the closing price of a stock value to its price range. The formula is:

-

SO: Stochastic oscillator

-

CP: Closing price

-

LP14: Lowest price of the previous 14 trading days

-

HP14: Highest price of the previous 14 trading days

In Pandas the only mistery is to calculate the lowest and highest price of the previous 14 trading days and then fill the formula in another DataFrame column.

ua['L14'] = ua['Low'].rolling(14).min()

ua['H14'] = ua['High'].rolling(14).max()

ua['SO'] = ((ua['Close'] - ua['L14']) / (ua['H14'] - ua['L14'])) * 100The SO is not meant to be shown over the price plot. You normally see it side by side as a different chart at the bottom of the stock prices chart.

# DRAWING SO

from matplotlib.gridspec import GridSpec

import matplotlib.patches as mpatches

# GRID TO LOCATE PRICE AND SO CHARTS

fig = plt.figure(figsize=(15, 5))

gsp = GridSpec(2, 1, height_ratios=[4, 3], hspace=0)

ax1 = fig.add_subplot(gsp[0])

ax2 = fig.add_subplot(gsp[1], sharex=ax1)

# PRICE CHART

ax1.plot(xs, ys, label='Price', color="blue")

ax1.set_title('UNDER ARMOUR STOCK PRICES (OCT-2019 - OCT-2020)')

ax1.set_ylabel('PRICE (US Dollars)')

ax1.set_yticks(np.arange(np.floor(ys.min()) - 2, np.ceil(ys.max()) + 4, step=2))

ax1.set_xticks([])

ax1.grid(axis='x', linestyle='--')

# SO CHART

xaxis = ax2.xaxis

xaxis.set_major_locator(mdates.MonthLocator())

xaxis.set_major_formatter(mdates.DateFormatter('%b'))

ax2.plot(xs, ua['SO'], color='red', linestyle='-')

ax2.grid(axis='x', linestyle='--')

# HIDDING LAST Y TICKS IN SO CHART

ax2.set_yticks(np.arange(0, 200, step=50))

ax2.set_ylim(0, 150)

plt.setp(ax2.get_yticklabels()[-1], visible=False)

# COMBINED LEGEND

prices_patch = mpatches.Patch(color='blue', label='Prices')

stocha_patch = mpatches.Patch(color='red', label='Stochastic')

ax1.legend(handles=[prices_patch, stocha_patch])

plt.show()As a rule of thumb, most of the sources say that values over 80% are considered overbought whereas values below 20% are considered oversold.

Resources

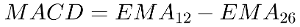

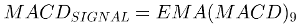

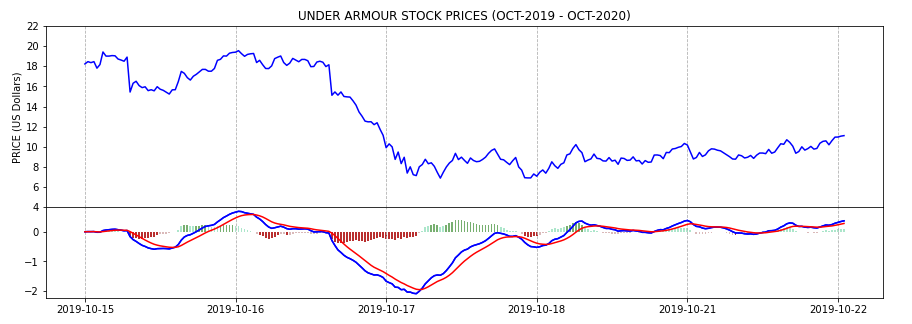

Momentum: MACD

The MACD is another trending indicator. It’s the difference between a 12 period EMA minus a 26 period EMA. It’s normally shown together with the MACD SIGNAL and a MACD histogram.

ua['EMA 26'] = ua['Close'].ewm(span=26).mean()

ua['EMA 12'] = ua['Close'].ewm(span=12).mean()

ua['MACD'] = ua['EMA 12'] - ua['EMA 26']

ua['MACD SIGNAL'] = ua['MACD'].ewm(span=9).mean()

ua['MACD HIST'] = ua['MACD'] - ua['MACD SIGNAL']import matplotlib.ticker as ticker

from matplotlib.gridspec import GridSpec

import matplotlib.patches as mpatches

# GRID TO LOCATE PRICE AND SO CHARTS

sto = plt.figure(figsize=(15, 5))

gsp = GridSpec(2, 1, height_ratios=[4, 3], hspace=0)

st1 = sto.add_subplot(gsp[0])

st2 = sto.add_subplot(gsp[1], sharex=st1)

# USING A NORMALIZED X AXIS TICKS

thex = np.arange(len(ua))

# DRAWING PRICE CHART

st1.plot(thex, ys, label='Price', color="blue")

st1.set_title('UNDER ARMOUR STOCK PRICES (OCT-2019 - OCT-2020)')

st1.set_ylabel('PRICE (US Dollars)')

st1.set_yticks(np.arange(np.floor(ys.min()) - 2, np.ceil(ys.max()) + 4, step=2))

st1.grid(axis='x', linestyle='--')

# DRAWING MACD CHART

st2.plot(thex, ua['MACD'], color='blue')

st2.plot(thex, ua['MACD'], color='blue')

st2.plot(thex, ua['MACD SIGNAL'], color='red')

pos_his1 = ua.loc[ua['MACD HIST'] > 0.2]

pos_his2 = ua.loc[(ua['MACD HIST'] >= 0.0) & (ua['MACD HIST'] <= 0.2)]

neg_his1 = ua.loc[(ua['MACD HIST'] < 0) & (ua['MACD HIST'] >= -0.1)]

neg_his2 = ua.loc[ua['MACD HIST'] < -0.1]

st2.bar(pos_his1.index, pos_his1['MACD HIST'], width=0.6, color='#77af70')

st2.bar(pos_his2.index, pos_his2['MACD HIST'], width=0.6, color='#ace6cb')

st2.bar(neg_his1.index.values, neg_his1['MACD HIST'], width=0.6, color='#dababa')

st2.bar(neg_his2.index.values, neg_his2['MACD HIST'], width=0.6, color='#b92f2f')

st2.xaxis.set_major_formatter(ticker.FuncFormatter(lambda x, pos: ua.iloc[pos, 0]))

st2.grid(axis='x', linestyle='--')

plt.show()

One way of using the MACD is noticing that when the MACD crosses above the signal it’s telling the traders is a good moment to buy whereas when the MACD crosses below the signal it’s a good moment to sell. Of course this also depends on the trading strategy of everyone.

Resources

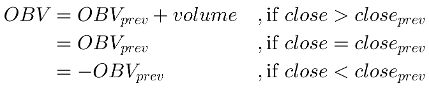

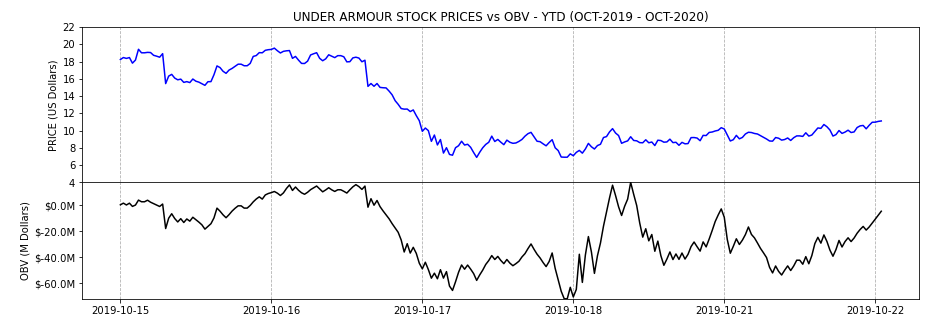

Volume: On-Balance-Volume (OBV)

Finally here’s the last indicator to create. The On-Balance-Volume is another trending indicator. It’s normally used to know if there’re many traders jumping in or jumping out of a given value. The formula of the OBV:

A possible translation of the formula to Pandas would be something like this:

ua['OBV'] = np.where(

ua['Close'] > ua['Close'].shift(1), ua['Volume'],

np.where(ua['Close'] < ua['Close'].shift(1), -ua['Volume'], 0)

).cumsum()Then plotting this with matplolib:

import matplotlib.ticker as ticker

from matplotlib.gridspec import GridSpec

import matplotlib.patches as mpatches

from matplotlib.ticker import FuncFormatter

# GRID TO LOCATE BOTH CHARTS

sto = plt.figure(figsize=(15, 5))

gsp = GridSpec(2, 1, height_ratios=[4, 3], hspace=0)

st1 = sto.add_subplot(gsp[0])

st2 = sto.add_subplot(gsp[1], sharex=st1)

# SHARED X VALUES

thex = np.arange(len(ua))

# PRICE CHART

st1.plot(thex, ys, label='Price', color="blue")

st1.set_title('UNDER ARMOUR STOCK PRICES vs OBV - YTD (OCT-2019 - OCT-2020)')

st1.set_ylabel('PRICE (US Dollars)')

st1.set_yticks(np.arange(np.floor(ys.min()) - 2, np.ceil(ys.max()) + 4, step=2))

st1.grid(axis='x', linestyle='--')

# OBV CHART

st2.plot(thex, ua['OBV'], color='black')

# FUNCTION TO FORMAT MILLIONS

def millions(x, pos):

'The two args are the value and tick position'

return '$%1.1fM' % (x * 1e-6)

formatter = FuncFormatter(millions)

st2.yaxis.set_major_formatter(formatter)

st2.xaxis.set_major_formatter(ticker.FuncFormatter(lambda x, pos: ua.iloc[pos, 0]))

st2.grid(axis='x', linestyle='--')

st2.set_ylabel('OBV (M Dollars)')

st2.set_ylim([ua['OBV'].min() - 1000, ua['OBV'].max() + 1000])

plt.show()

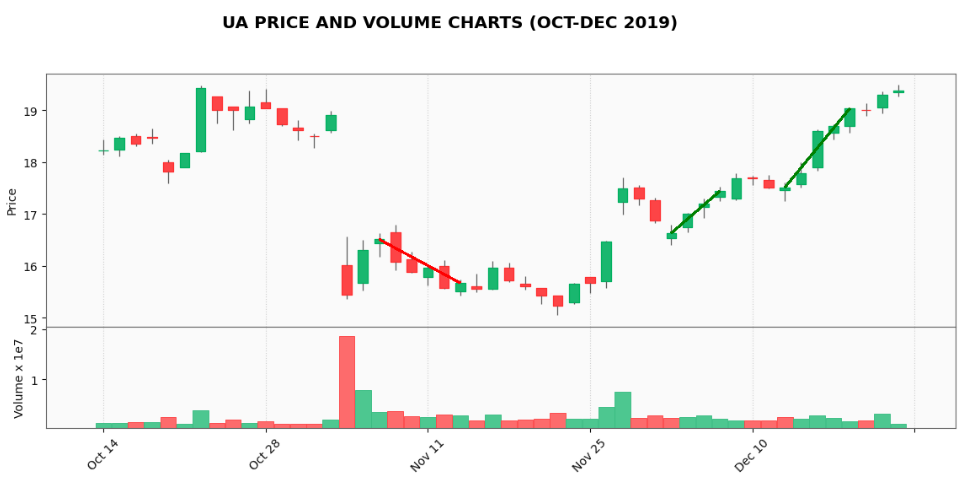

mplfinance

mplfinance is a matplotlib module specially suited for showing financial data. I didn’t have the time to play with it fully but it seemed to me a very useful tool if you need to plot financial data very often. To use it in the Jupyter notebook:

import sys

!{sys.executable} -m pip install mplfinanceFor example to see how easy is to create financia data, here’s the required code to show prices (with candlestick mode) and volume chart of the first 50 days. I’ve also included a couple of trending lines.

import mplfinance as mpl

# it requires the index to be a time series

ua['Date'] = pd.to_datetime(ua['Date'])

mpl.figure()

# adjusting overall styles

style = mpl.make_mpf_style(

y_on_right=False,

base_mpf_style='yahoo',

gridaxis='vertical',

edgecolor='#666666',

gridstyle=':')

data = ua.set_index('Date').iloc[0:50]

# almost everything happens within the plot() function

mpl.plot(

data, # first 30 days

type='candle',

volume=True,

title='UA PRICE AND VOLUME CHARTS (OCT-DEC 2019)',

style=style,

figratio=(11,8),

figscale=0.85,

figsize=(15, 6),

mav=(),

tlines=[

dict(tlines=[('2019-11-06', '2019-11-13')], colors='r'),

dict(tlines=[('2019-12-03', '2019-12-08'), ('2019-12-12', '2019-12-18')], colors='g')

])

mpl.show()

As you can see the required number of lines is really low compared to previous examples. I think it’s worth spending a little bit more time with it in the future.

Other Resources

Article source code

-

Jupyter notebook: ua_analysis.ipynb.